change in net working capital dcf

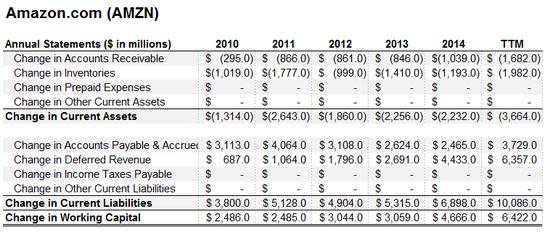

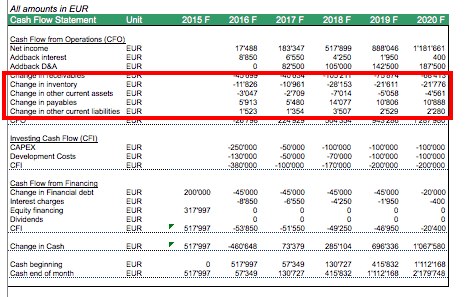

In this case the change in working capital is computed using the formula above and it is dramatically less. The Working Capital is the measure of cash needs of the company for day-to-day business activities it is the short term financing needs of the expanding.

Changes In Working Capital And Owner Earnings The Complete Guide

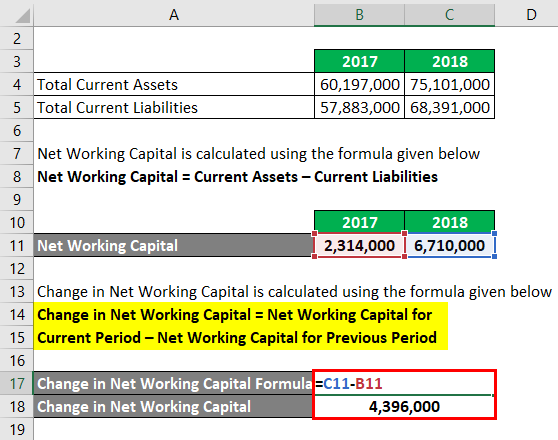

Change in Net Working Capital 12000 7000.

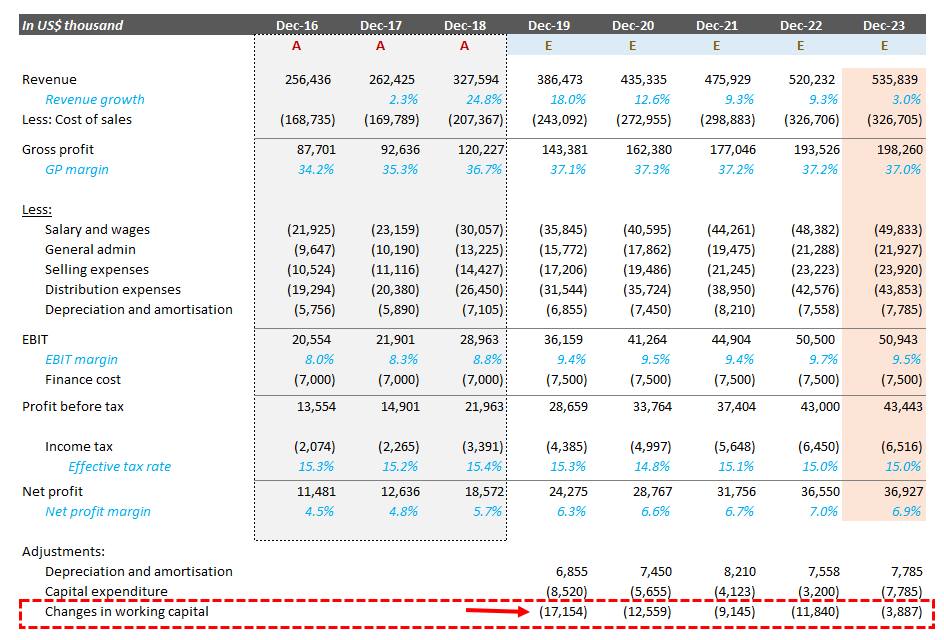

. Net Working Capital Current Assets less cash Current Liabilities less debt or NWC Accounts Receivable Inventory Accounts Payable The first formula above is the. The entire intuition behind CA-CL is to arrive at how cash. In this environment its fair to ask if the discounted cash flow DCF.

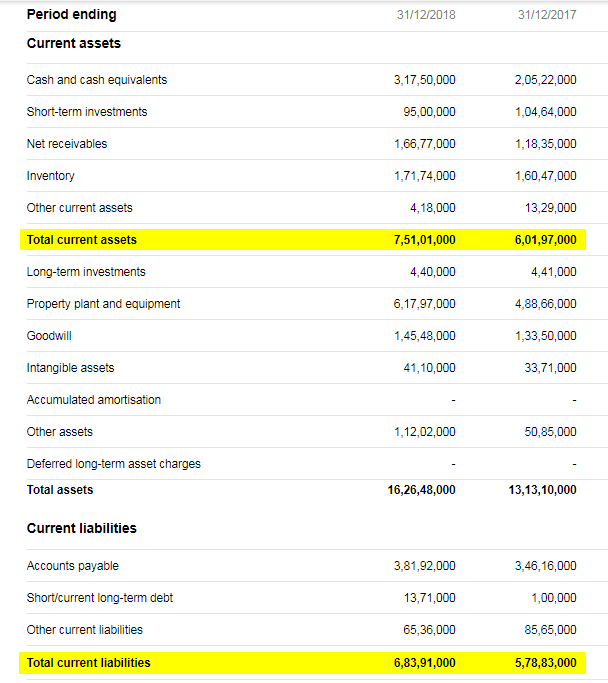

Working capital is usually defined to be the difference between current assets and current liabilities. Change in Working Capital is a cash flow item and it is always better and easier to use the numbers from the cash flow statement as I showed above in the screenshot. This indicates that the firm is out of funds.

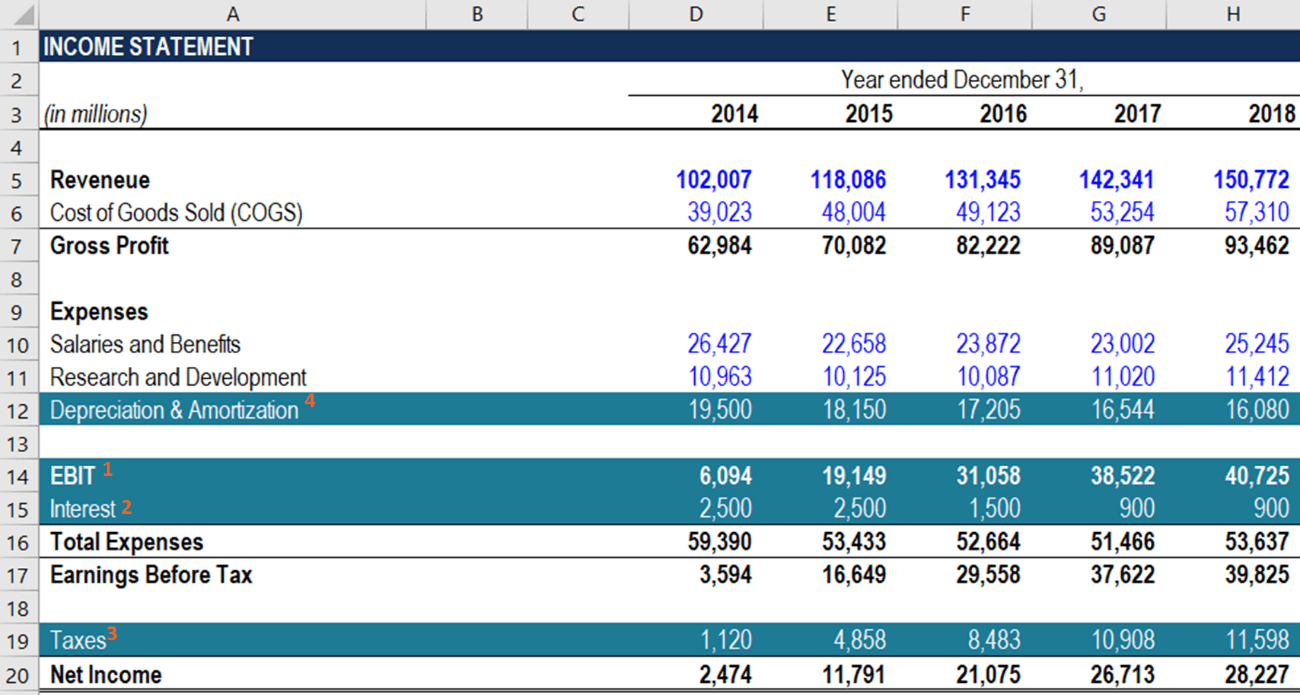

When the company finally sells and delivers these products. Therefore Microsofts TTM owner earnings come out to be. Therefore the Change in Working Capital 200 300 100 so its negative and it reduces the companys cash flow.

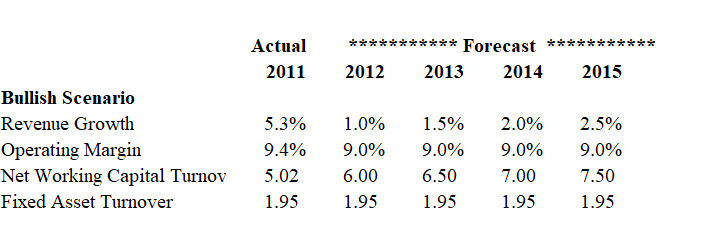

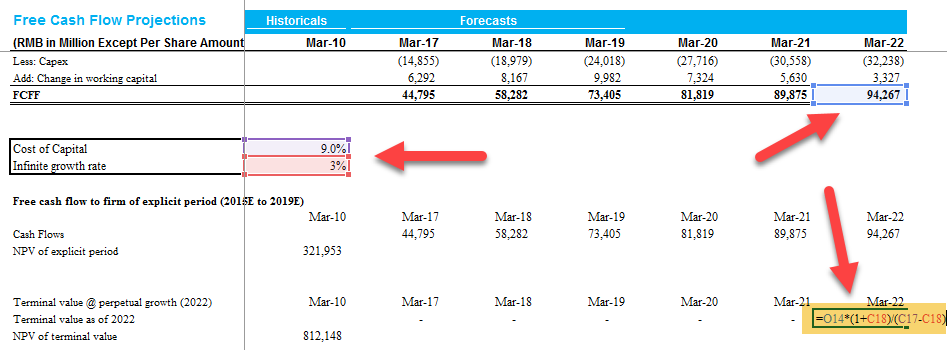

How do you project changes in net working capital NWC when building your DCF and calculating free cash flow. Change in Net Working Capital NWC Prior Period NWC Current Period NWC As a sanity check you should confirm that if the NWC is growing year-over-year the change should be. Net changes in working capital are adjusted in the free cash flow projections to arrive at the free cash flow.

When you use the lower number for changes in working capital and then. However we will modify that. In this video I cover.

If youre asking whether you include cash in the CA to get to change in net working capital the answer is no. Similarly change in net working capital helps us to understand the cash flow position of the company. In Scenario A the change in invested capital was 25m more for an.

A negative change in. In this video I cover the different ratios tha. Changes in net working capital show.

Thus the value of working capital in 2021 comes out to be -9972000000. In the DCF method change in working capital would exclude change in cash cash equivalents and current financial debt and include non financial items such as change in inventories. Here you can see the value comes out to be negative.

Working capital in valuation. Working capital in valuation. FCF is the free CF.

The net working capital ratio formula is 600000 of current assets divided the 350000 of current liabilities for a working capital ratio of 171.

Dcf Terminal Values Returns Growth And Intangibles The Footnotes Analyst

Training Modular Financial Modeling Ii Dcf Valuations Equity Dcf Valuation Dcf Valuation Modano

Calculate The Change In Working Capital And Free Cash Flow

Non Cash Working Capital A Critical Component Of Valuation And Fcf

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Dcf Model Training Free Guide Vkontakte

Negative Working Capital Made Easy The Ultimate Guide 2021

Change In Net Working Capital Formula Calculator Excel Template

How To Calculate Fcfe From Ebit Overview Formula Example

How To Forecast The Balance Sheet Efinancialmodels

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

How To Compute Cash Flows From Net Working Capital Changes Youtube

Change In Net Working Capital Nwc Formula And Calculation

Discounted Cash Flow Dcf Valuation Model 7 Steps

Changes In Net Working Capital All You Need To Know

Dcf And Pensions Enterprise Or Equity Cash Flow The Footnotes Analyst

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube